Patients appear dissatisfied with the dental service/support organization (DSO) experience, according to the results from a new survey. Those who received services from DSOs ranked their customer experience far below that of other industries, including insurance and retail.

Management and consulting firm West Monroe Partners asked thousands of patients how likely they were to recommend their DSO and what factors were most important them. In a brief with the survey findings, authors Kristin Irving and Paul Hagen advised DSOs to focus on bringing in quality dentists, rather than opening additional locations.

"It's likely that consolidation in the dental industry has made firms focused on driving revenue through acquisition rather than retention," Irving, senior director for West Monroe Partners' healthcare division, told DrBicuspid.com. "The problem is that those DSOs will likely lose many patients in the process, resulting in hindered performance compared to what they could achieve if they focused more on patients."

Quality over quantity

It's no secret that one of the more influential trends in the dental industry is the shift to larger, consolidated dental practices, such as dental service and support organizations. A 2015 report from the ADA found that the largest of these dental firms more than tripled their number of locations from 2002 to 2012, and the growth doesn't appear to be slowing anytime soon.

“Quality care is a foundation of positive patient experience.”

The rise of DSOs mean that more patients will be getting care from these organizations, and they will have more partner dental offices to choose from. Therefore, it's important to get a baseline understanding of what patients think about the current DSO experience.

To find out, West Monroe Partners and a dental payor emailed a survey to 2,000 people who had been a patient at one of 10 unnamed dental support organizations. To ensure accuracy, the survey was sent to at least 100 patients from each DSO.

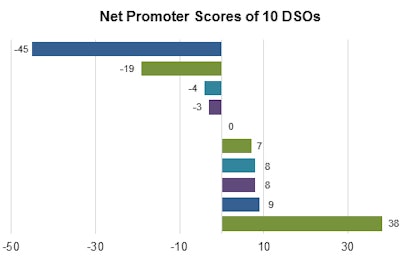

The survey used Net Promoter Score (NPS) to gauge patient satisfaction. This score is a tool used to evaluate customer loyalty and satisfaction based on the willingness of that person to recommend a product or service provider. Organizations with high scores have customers who are more likely to recommend that product or service.

The 10 DSOs surveyed had an average score of 1. To put that in perspective, the average scores for other industries usually range from 35 to 50, with the top organizations scoring above 60. For instance, the average score is 18 for the health insurers and 58 for department and specialty stores.

In addition, a large gap in scores existed between the top- and bottom-ranked DSOs, which is practically unheard of in other industries, according to the report.

"There was an 80-point difference between the top and bottom DSO when rated for patient experience," Irving said. "That means bottom-performing DSOs will have a poor reputation among patients, and, therefore, the future performance of the business will trend downward. On the other hand, top-performing DSOs will likely be better to work with and gain positive momentum, and their business will trend upward as a result."

For patients, the quality of their dentist was one of the top factors that influenced their score, followed by the ease of dealing with the office staff. In fact, quality dentists mattered far more to patients than the number of locations each DSO had.

"Quality care is a foundation of positive patient experience, but it doesn't stop there," Irving said. "Good practices will borrow from other industries and look at how firms like Fidelity develop a sense of empathy for customers, firms like OpenTable make scheduling easier, and firms like Safelite Autoglass create trust through transparent and clear communications."

Relevance for private practice

The report didn't just include the survey results. Irving and Hagen also provided recommendations that DSOs and dental payors can take steps to improve the customer experience, including the following:

- Publish dentist ratings.

- Bring services to where patients are, such as schools, workplaces, or drugstores.

- Use data to optimize scheduling and reward positive, daily habits.

- Make pricing more transparent.

West Monroe Partners did not survey patients of private dental practices; therefore, it is uncertain whether patient dissatisfaction is a problem throughout the whole dental industry or limited to DSOs. However, the recommendations have relevance for dentists in private practice, too, Irving said.

"Patient experience and its impact on business through retention and word-of-mouth impact private dental practices as much as DSOs," she said. "If reputation and word-of-mouth are important to private dental practices, then the advice we gave to DSOs is equally applicable."