The medical and dental insurance markets have operated in separate silos for decades. But that could start to change -- and sooner than you think. Industry insiders say the question isn't if the two industries will converge, but rather when and how.

Management and consulting firm West Monroe Partners surveyed 125 C-level executives at medical and dental plans about their thoughts on the future of their industries. Nearly 100% of the executives believe that dental benefits will eventually become embedded into medical plans, and some believe that the convergence could begin in as few as three to five years.

Kristin Irving. All images courtesy of West Monroe Partners.

Kristin Irving. All images courtesy of West Monroe Partners.The full embedding of dental benefits within medical plans is much further on the horizon, cautioned survey authors Kristin Irving and Benjamin Baenen. But, the revolution could start soon, likely with a partnership between a large medical payor and a large, standalone dental payor.

"The medical payors, they've lost a lot of profit from individuals plans," Irving, the senior director for West Monroe Partners' healthcare division, told DrBicuspid.com. "They're looking for other types of products or diversification in which they can make a profit, which means they're looking toward dental to see how can they sell dental products, whether they can embed dental in a medical plan, [and] how do they offer more to their members in order to make it easier."

When worlds collide

The worlds of dental and medicine operated in separate silos for more than a century, not only for places of practice but also for provider education, health benefit companies, government regulation, and insurance codes and infrastructure. But new technology may change all that. For the first time, software will have the capability of including both medical and standalone dental insurance codes and charts, which could be the key to convergence.

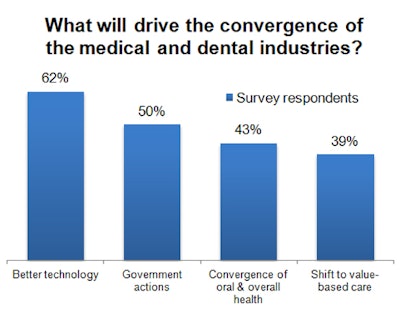

The majority of dental and medical respondents agreed that better technology that can provide a holistic view of patients would ultimately be the top reason for dental finally becoming embedded within medical plans. Both types of executives also agreed that medical insurance companies would have an advantage over dental payors.

Benjamin Baenen.

Benjamin Baenen."There was an acknowledgment in the study that health plans' claim systems are more complex based on the complexity of health benefits," Baenen, senior manager for West Monroe Partners' healthcare division, told DrBicuspid.com. "That could be a competitive advantage they have over dental plans."

While it doesn't look like any drastic changes will happen in the near future, the convergence could start within a few years in the form of a partnership, Irving and Baenen said. This has already happened in other realms of the insurance industry, where home, automobile, and life insurance used to be sold through separate, standalone companies but are now often consolidated under one corporation.

"Consumers want the one-stop shop," Irving said. "They want State Farm for their home insurance. They want State Farm for their auto insurance. One bill makes it easier. And that's where, given members' experiences and expectations, we're starting to see a shift in 'Why wouldn't the medical payors start providing dental?' "

Regulatory pressures, such as the Patient Protection and Affordable Care Act (ACA), also have pushed medical plans to look for new ways to make a profit. The dental industry, in particular, looks promising because dental benefits and dental care are not as heavily regulated as the medical side of the healthcare industry. Furthermore, dental plans tend to have higher profit margins.

Don't panic (yet)

Irving and Baenen agreed that the day-to-day operations for dentists won't change much in the near future. Although half of the surveyed dental executives felt as though the convergence of medical and dental plans is a threat to their businesses, 24% don't intend to change anything.

“Consumers want the one-stop shop.”

However, an eventual partnership could lead to a future in which medical, dental, and vision are all offered through one company. This could bring the opportunity for dentists to provide better overall patient care. In fact, Baenen sees a future in which dental offices could be a hub for preventive checks and screenings.

"Could you have a one-stop shop where you went to the dentist and there was some medical element to that visit?" he asked. "One of the executives told us younger males go to the dentist every year twice a year, and they never go to the doctor. ... This idea is almost community-based dentists who do more than just dental because of this embedded plan. You'll see more holistic coverage."

But it also begs the question whether this change could affect dental practice ownership. In 2015, about 80% of dentists were practice owners, compared with just 47% of physicians. Could the consolidation of dental and medical benefits also be linked to a future in which the majority of dentists aren't business owners either?

This may be where dental service organizations (DSOs) fit in, Irving noted.

"We're starting to see the rise in DSOs and the footprints increasing to the number of practices and locations that they have," she said. "What will ultimately happen with the DSOs? Could a health system, a hospital, buy them to start to see more convergence between medical and dental? Potentially."

But for now, no one knows for sure how or when the convergence of medical and dental plans will shake out. Only that it is coming, and dentists should be ready because once the convergence starts, there's no looking back.

"It is on the minds of a lot of people, and it's going to take someone to do this the right way," Baenen said. "Once that happens, a lot of people are going to start jumping on board."