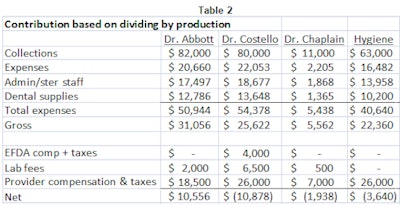

Our next method of assigning expenses to determine the profitability of each provider team is to allocate the expenses based on production. Using the same allocation from dental supplies expense assignment from the first two examples, we apply the other expenses in this same manner but using production as the basis.

With this allocation, Dr. Costello is carrying the highest percentage of expenses, staff, and dental supplies, while the load has lightened substantially for Dr. Chaplain. With this profitability analysis, we can see that Dr. Abbott is again the most profitable dentist for the month, acknowledging that he and Dr. Costello may very well take turns at having the highest production in any given month. They will end up carrying a similar expense percentage for the year even though they practice differently. Our senior has a small loss and our hygienists a loss as well, but these seem to appear more even-handed and may help to focus managing of the expense side of the equation.

Jill Nesbitt, MBA, is a dental group practice management consultant from Nashville, TN, who also serves as the chief operating officer for a multilocation group.

Jill Nesbitt, MBA, is a dental group practice management consultant from Nashville, TN, who also serves as the chief operating officer for a multilocation group.Dividing by production provides the best calculation so far for contribution because the differences appear to be more "fair." We're not biased against our senior because, although he is less productive, he also carries less of the practice's expense.

Looking at the loss of the hygienist team, we realize that our administrative team spends easily as many hours scheduling prophies as treatment, and our sterilization staff helps turn over hygiene rooms and perio chart as often as cleaning burs and running the autoclave.

Therefore, the expenses seem allocated appropriately, and this may motivate the owner to develop the skills of the hygienist team -- and delve more deeply into an evaluation of the individual hygienists to find success that can be trained across the rest of the team.

Feedback

Our owner can also provide solid feedback to Drs. Abbott and Costello. Since these dentists work similar hours and have nice production levels, showing individual month performance alongside year-to-date will help manage the competitive spirit between our providers (and friends). At the same time, we would recommend removing the line displaying provider compensation and taxes from any evaluation shown to all dentists -- no reason to light a fire unnecessarily. In fact, looking just at the comparison between our two full-time dentists, we can see that although Dr. Abbott won the contribution contest this month, our two dentists are performing solidly.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.When meeting with Dr. Costello, the owner can begin by praising his production and his contribution to the profitability of the practice, but end with the acknowledgement that because of his substantial income (which was established in our original contract), this month ended up at a loss for the corporation. During this meeting, the owner needs to be on the lookout for a sense of hopelessness and frustration from Dr. Costello following the theme of, "I just had one of my best months ever, and I'm showing a $10,878 loss? This poorly run company is making me look bad. I wonder if I worked elsewhere, would I be more appreciated!" This upset can be mitigated with the reality of the expenses (described in more detail at the end of this article) and the ongoing efforts to reduce them.

One way of approaching this is to show contribution and avoid the depiction of any loss by selectively eliminating the line item, "provider compensation and payroll taxes." It is uncanny how a selective showing of the contribution of your two lead dentists results in a positive rather than negative reaction toward their consent and willingness to continue in a manner that will more ably assist the profitability of the corporation as a whole. The next table shows a selective way of handling lead dentists to make them allies of change and not adversaries.

The series concludes next week with an analysis and practical takeaways.

Thomas Climo, PhD, is a financial consultant with offices in Las Vegas and Melville, NY. He was a tenured professor of economics at a major university in England and currently handles the dental practice management/dental service organization (DPM/DSO) framework for more than a dozen solo practitioner dentists in 10 states, each with multiple facility practices. He can be reached by phone at 702-578-2757 or by email at [email protected].

Jill Nesbitt, MBA, is a dental group practice management consultant operating from Nashville, TN, who was for more than 15 years a practice administrator for a large single-office dental group in central Ohio and now serves as the chief operating officer for a multilocation group. She can be reached by phone at 615-970-8405 or by email at [email protected].

The comments and observations expressed herein do not necessarily reflect the opinions of DrBicuspid.com, nor should they be construed as an endorsement or admonishment of any particular idea, vendor, or organization.