The placing of a titanium dental implant by Per-Ingvar Brånemark into the mouth of a volunteer in Sweden in 1965 was a turning point in restorative dentistry. Over the past 40 years, dental implants have become a preferred means of treatment for missing teeth for many clinicians and patients while growing into a $3 billion market worldwide by 2009.

By 1988, some 300,000 implants had been placed throughout the world, according to Kai Klimek, DDS, PhD, global manager market communication at Nobel Biocare. Today the number of new implants placed annually now exceeds that figure by a considerable margin, with estimates ranging from 1.3 million to 2 million annually in the U.S., which accounts for 30% of the worldwide market.

"At a recent conference, I heard several speakers say the same thing: For their practice and in the industry, implant treatment is the biggest breakthrough technology in the last 10 years," Jim Frontero, president and head of sales at Straumann USA, told DrBicuspid.com.

In fact, until the economic downturn, the implant market was growing at a rate of about 15% year over year. But that growth has slowed considerably in the last few years, creating new challenges in an increasingly competitive segment of the dental market.

"In 2009, the implant market was essentially flat to slightly negative; in 2010, there was a bit of a recovery to low, single-digit growth," Frontero said. "Today, eight to nine months into 2011, it's still in single-digit growth."

Midyear revenues from 2011 reflect a market that is still finding its footing. In August, Straumann reported revenues of 367 million Swiss francs ($463 million) for the first six months of the year, a decrease of 6.5% over revenues of 392.4 million francs ($495 million) for the same period in 2010. Net profit fell by 53%.

Similarly, Nobel Biocare saw its profits drop 51% in the first half of 2011 on revenues of 286.4 million euros ($408 million) for the first half of 2011, down 1.4% from revenues of 291.6 million euros ($415.9 million) for the same period in 2010.

New products and materials

As a result, implant makers are actively working to give themselves an advantage over their competition through new developments in technology and materials. For example, Straumann has developed a proprietary blend of titanium and zirconium called Roxolid.

“At the end of the day, when the patient smiles, they want to have a natural-looking smile.”

— Jim Frontero, president,

Straumann USA

"That resulted in a stronger material, which translates into our ability to manufacture narrower, thinner implants to be placed in more compromised spaces without sacrificing the integrity of the implant," Frontero explained.

Despite the success of titanium, some companies are continuing to experiment with ceramics, which have one key advantage: superior aesthetic appearance, according to Dr. Klimek. Consequently, Nobel Biocare will continue to offer full ceramic abutments as an element of its implant business.

"Ceramic implants are expected to remain a niche product from niche providers for a rather small group of patients in the future," he said.

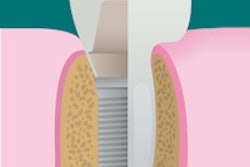

Nobel Biocare is also banking on a new implant geometry, Dr. Klimek added. The NobelReplace Conical Connection combines the tapered NobelReplace implant body with an internal conical connection and built-in platform shift to increase soft tissue health and volume. The result is an implant-abutment connection with an extremely tight seal, according to the company.

"The sealing prevents the ingress of bacteria and thus ensures that the implant-based restoration has a long service life," Dr. Klimek said. That same innovation, he said, will reduce the risk of peri-implantitis.

Meanwhile, Dentsply International -- which recently acquired Astra Tech, expanding its implant offerings beyond its Friadent and XiVE brands -- is focusing on other implant innovations.

"Most properly placed dental implants will osseointegrate," said Dennis Thompson, DDS, Dentsply Tulsa dental specialties' director of clinical services, bone and implant dentistry. "As a result, the battleground for future expansion of the implant market will be waged above the implant platform with new generational changes in the abutment, crown composition, and the addition of advanced biologics."

More patients needed

One consequence of the economic downturn is that more clinicians are placing implants to diversify their practices. Dentsply estimates that 35,000 practitioners from different specialties are placing them today. But most are still placed by oral and maxillofacial surgeons and periodontists, Frontero noted.

"That's not to say that other specialty groups aren't active," he said. "General practitioners are [placing them] and maybe even getting a little more active in light of the recent economy. Endodontists are also getting more involved."

These clinicians all face a similar challenge: an underpenetrated market. Only 15% to 20% of patients who are indicated for an implant actually undergo treatment, Frontero noted.

"There is a whole host of reasons why that number is relatively low," he said.

Cost is the primary factor. And while insurance companies are evolving to offer coverage for implant procedures, they have yet to play a significant role in mitigating costs.

"The perception is that implants are expensive and beyond the financial capability of the average consumer," Dr. Thompson said.

So what can clinicians do to increase the number of implants they place? Patient education is key, the vendors noted.

"Explain the long-term benefits of implant tooth replacement," Dr. Thompson said.

Frontero concurred. "Consider the value of longer expectancy; you don't have to replace the crown, generally, like you do with the crown and bridge eight to 10 years out," he said.

Doctors' obligation to discuss the benefits and limitations of each treatment option is an opportunity to educate, they both noted.

"Unless the patient is confronted with insurmountable clinical or financial barriers, most astute patients are choosing implants when a permanent solution is available," Dr. Thompson said. "This proven treatment modality should always be included in the treatment planning options for replacement of missing teeth."

Increased predictability and precision provided by CAD/CAM technology has helped clinicians become more comfortable with offering implant treatment, he added.

"This means fewer headaches and less frustration on the part of clinicians, labs, and the patient," Dr. Thompson said.

The number of visits required and the length of time it will take to complete a treatment plan are among patient concerns. Referrals to specialists and visits back and forth between them for different phases of the treatment can be daunting, Frontero noted.

"CAD/CAM treatment and digitalization can shorten that time frame and also provide materials at the time of these appointments that would allow, as an example, the doctor to temporarily restore an implant at the time the implant is placed, saving a visit," he explained.

Functionality is a pivotal aspect of what can make implants an ideal choice for the right patient.

"Amongst the available options for dental restoration, implants restore the function of a missing tooth best," Dr. Klimek said. "Due to the solid anchoring in the jaw bone, implants guide the forces that are generated during mastication in the bone in a manner much like the natural root," which can prevent the jaw bone from receding.

Alternative treatments may not provide optimum results, he added.

"Any modern therapy aims to achieve a visually inconspicuous result after the cementing of the permanent restoration is completed," Dr. Klimek said. "Conventional restorations involving fixed or removable dentures achieve this goal only incompletely."

A dental implant can also be a low-impact treatment on neighboring teeth, which may serve as abutments or are used to attach bridges in other restorations. "You're essentially modifying otherwise healthy teeth to put a bridge across the space you're trying to fix," Frontero said.

Asthetics is a key factor when it comes to explaining the benefits of implants, he added.

"I think it comes back to what patients are looking for, right? They want a tooth," Frontero continued. "At the end of the day, when the patient smiles, they want to have a natural-looking smile and not something mechanical."