The U.S. market for dental implants will regain double-digit growth by 2013 and will help drive the dental prosthetic market to reach more than 82 million prosthetic placements by 2016, according to a new report from iData Research.

The dental bone-graft-substitute (BGS) market is also expected to double in value, according to the company. Adoption of new technologies such as computer-aided design and manufacturing (CAD/CAM) will boost growth in these markets, iData said.

Smaller dental implant companies have been instrumental in fueling sales in the implant and prosthetics markets, according to the report. These companies, such as Implant Direct and Blue Sky Bio have been gaining market share in recent months, iData said.

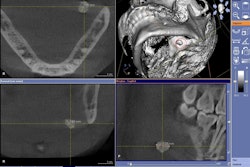

"Dental implants have earned the reputation of being the best aesthetic option for single-tooth replacement," said Kamran Zamanian, CEO of iData. "By 2016, over 20% of general practitioners are expected to place dental implants, and their adoption of computer-guided surgery will further the growth of this market."

The company is forecasting double-digit growth for CAD/CAM-manufactured prosthetics, which it expects to take market share from conventionally made prosthetics. More dental laboratories are adopting the CAD/CAM technology, particularly due to falling prices of CAD/CAM blocks and the appeal for faster and more accurate prosthetic manufacturing, iData said.

The reports also state that the release of new BGS products from companies such as BioHorizons, Biomet 3i, and Zimmer Dental will drive dental implant use. Advancements in allograft and synthetic materials are increasing the application of BGS, and expanding the pool of patients eligible for dental implants and prosthetics.

Another marketing research company, Research and Markets, has also issued a mostly positive assessment of the implant business. An aging population that loses more teeth, combined with increased awareness of oral health, bodes well for the market, the company said.

On the other hand, the high cost of implants in a tough economic environment, limited insurance coverage, and strict government regulation all are continuing to challenge the market, Research and Markets added.

Copyright © 2010 DrBicuspid.com