Dentists' earnings are not rebounding despite several years of economic recovery, according to new ADA research. Recent years have seen a stagnation of dental spending, an increased number of dentists and, as a result, stagnant dentist earnings, the study found.

"Dentistry is a profession in transition," noted the December report by ADA Health Policy Institute researchers Bradley Munson and Marko Vujicic, PhD. The study included dentists' earnings through 2013.

If the dental sector is entering an era of stagnant demand for dental care and an increasing supply of dentists, this will have important implications for dental practices, the researchers noted.

"A 'new normal' of flat dentist earnings could be emerging," the study authors wrote.

A range of factors in the early 2000s led to a decline in average dentist net income, including a steady decrease in dental care among adults, which began well before the recent economic downturn and shows no sign of reversing, the researchers found. The analysis shows that a "new normal" may be emerging in terms of dental spending, demand for dental care, and dentist earnings.

The report used 2013 data from the ADA's annual survey of 4,000 to 17,000 dentists in private practice, which includes 92.2% of active dentists in the U.S. The survey's response rate was 18.4%.

Net income was defined as income remaining after practice expenses and business taxes and included salary, commission, bonus and/or dividends, and payments to retirement plans.

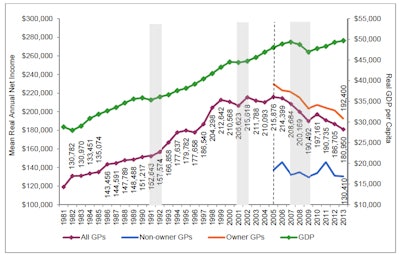

The survey defined owner-dentists as sole proprietors or partners (one of two or more owners/shareholders). Employed dentists were defined as nonowners compensated on a salary, commission, percentage, or associate basis. The study compared the trend for dentist net income to per capita gross domestic product (GDP).

Chart courtesy of the ADA Health Policy Institute.

Improving economy but decreasing incomes

“Our analysis indicates that dentists' average net incomes are not recovering with the rebound in the U.S. economy.”

GDP per capita has increased each year from 2009 to 2013, and has fully recovered to prerecession levels. "The U.S. economy is clearly in steady recovery," the researchers noted.

In 2013, the average annual net income was $180,950 for general practitioner dentists (GPs) and $283,900 for specialists. The average annual net income was $192,400 for owner GPs and $130,410 for nonowner GPs. Net incomes have steadily decreased for specialists since 2007, according to the study authors.

"When adjusted for inflation, average incomes have decreased significantly since the peak value of $215,876, which occurred in 2005 and have actually decreased since 2009, the end of the Great Recession," they noted. "Clearly, our analysis indicates that dentists' average net incomes are not recovering with the rebound in the U.S. economy."

Many dentists not busy enough

Slower growth in dental spending was cited by the Centers for Medicare and Medicaid Services (CMS) in a September report that revised postrecession health spending from "low rates of growth" to "slowdown."

CMS projected $113 billion in dental expenditures during 2013 at a 1.9% annual growth rate.

Dental spending had been inching upward since 2008-2009 when it increased just 0.1% from $102.4 billion to $102.5 billion. The 2013 growth rate is the lowest since then, according to the CMS report.

The percentages of dentists self-described as "not busy enough" in 2013 were 36% for GPs and 37% for specialists, comparable to the substantial levels of 2012. Among GPs, 41% of solo practitioners (a single, owner-dentist in the practice) indicated they were not busy enough compared with 25% of nonowner GPs.

Average wait times did not decline in 2013 and appear to have made a slight turnaround, the study authors stated. The average wait time for a GP appointment decreased in half from 9.6 days in 2001 to 4.8 days in 2013 for a patient of record. New patients waited an average of 10.8 days in 2001, compared with 5.7 days in 2013.

Taken together with the decrease in busyness, the data suggest that significant unused capacity is available in the dental care system, the study authors found.

"With four full years of post-Great Recession data, dentist earnings are clearly not recovering," they pointed out.

More dentists practicing

Dentists' earnings in the period since the early 2000s have been affected significantly by the demand for dental care and aggregate dental spending. ADA research shows that the supply of dentists is expected to increase in the coming years.

"Looking forward, there is significant uncertainty both in the general healthcare environment as well as economic conditions within the dental sector," the researchers wrote. ADA analysis shows that if current dental care utilization trends continue -- and the most recent data show they are indeed continuing -- dental spending in the U.S. will not return to the historically high, pre-Great Recession growth levels.

An important caveat, however, is the potential impact of the Patient Protection and Affordable Care Act (ACA), the study authors noted.

"There will be significant expansion in demand for dental care among Medicaid adults as well as a (much smaller) increase in private dental benefits coverage," they wrote. However, it is unclear how much of an impact, if any, these changes will have on dental spending.