For many people having dental insurance is a valuable perk: They feel they can afford dentistry. But just because a policy states there are covered benefits, it doesn't necessarily mean the plan will pay the claim.

Dental plans aren't what they used to be. Over time, plans have added exclusions, waiting periods, alternate benefits, and tricky benefit wording to add to the confusion. Incorrect insurance verifications lead to low collections, high accounts receivable, outstanding claims, incorrect treatment plans, and unhappy patients.

Dr. James V. Anderson.

Dr. James V. Anderson.Dental plans, with all of their policy restrictions and limitations, can be a massive headache and a source of financial uncertainty for the dental practice. None of us want to work for free, but that is what can happen if you don't have a streamlined, efficient system for insurance verification.

Insurance verification 101

The insurance landscape is continually changing, and insurance verification is the No. 1 way to prevent incorrect dental and medical billing.

The insurance verification process requires a staff member to get a list of coverage benefits either through the insurance company's online members portal or by speaking to a representative. It seems easier to get information if you are a network provider. Sometimes, if you're lucky enough, patients will bring in their benefits booklet, along with their identification and enrollment information.

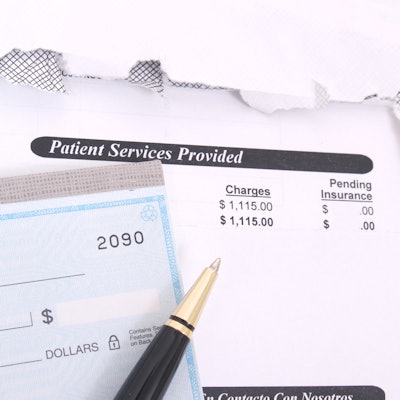

Failure to gather the complete verification could leave your practice with an unpaid claim from the insurance company or a patient red-faced and angry with unexpected expensive bills.

Proper insurance verification and preauthorization (where required) enables faster and more efficient payments, reduces debts, and enhances patient satisfaction. When you send out "clean" claims without errors, you speed up the processing time, resulting in a better cash flow.

Inadequate verification of eligibility and plan-specific benefits puts healthcare organizations at risk for claim rejections, denials, and rising debt. Since insurance information changes frequently, failure to stay ahead of ever-changing regulatory requirements could lead to rejected claims, billing errors, and reimbursement delays. Dental providers must be vigilant and verify the member's eligibility every time before services are provided.

Most patients want to know an accurate out-of-pocket responsibility upfront. Estimates are the least they should get, and your office should ensure they are as precise as possible.

Some procedures listed as covered are not when billed on a date that is out of the coverage range or without the criteria required to match the policy benefits level. Inefficient insurance verification will leave the patient financially exposed to a debt they didn't expect and angry toward the office. Often, bad reviews on social media follow.

Happy office manager, happy office

You've likely heard the saying, "Happy wife, happy life ." In the world of dentistry and insurance verification, I like to say, "Happy office manager, happy office."

That's because most solo and small group practices rely on the office manager and front desk team to verify eligibility, insurance coverage, and benefits before the patient incurs any treatment expense. Your dental office manager, strapped for time, cannot sit on the phone asking about the history of scaling and root planing, the date of a crown that was placed a "few" years ago, the limitations on specific codes that are not clear in the benefits booklet, and more.

Modern insurance verification requires careful consideration of the benefits, coverage, history, coinsurance or copayment, and deductibles. Having enough team members to verify plan coverage in advance for procedures or products results in fewer claims being denied.

To ensure that insurance verification is carried out accurately and promptly, the practice must have enough time to do the task or enough team members trained to gather the information. For the past couple of years, this has been a challenge because of the COVID-19 pandemic and the corresponding shortage of trained front office workers to achieve accurate insurance verification.

The SARS-CoV-2 virus has changed how we do things, but we have to learn to live with it and find solutions along the way. Outsourcing insurance verification to a billing company that charges a small fee per verification is one option to resolve the issue of not enough staff and not enough hours.

Dr. James V. Anderson is a practicing dentist in Syracuse, UT, and is the CEO and founder of eAssist Dental Solutions. He can be reached via email.

The comments and observations expressed herein do not necessarily reflect the opinions of DrBicuspid.com, nor should they be construed as an endorsement or admonishment of any particular idea, vendor, or organization.