Consumers spend more on dental services during tax-refund season, according to a new report from the JPMorgan Chase Institute. The increase in healthcare spending during March and April occurred for Chase customers from all income brackets, but it was highest for families with less than $536 in their checking accounts.

The sharp increase in healthcare spending after a tax refund may signal that patients are putting off treatments until they have additional cash. This trend is even more prominent for dental care, according to report author Fiona Greig, director of consumer research at the JPMorgan Chase Institute.

"Patients are not just asking themselves, 'Can I afford this procedure? Do I really need it?'" Greig told DrBicuspid.com. "They're also asking themselves, 'Can I afford this procedure today? Do I have to do it today?' Cash flow dynamics for consumers play an outsize role in when they receive healthcare, and that is even more pronounced for dental care."

Healthcare spending spikes when income spikes

Fiona Greig, report author and director of consumer research at JPMorgan Chase Institute. All images courtesy of JPMorgan Chase Institute.

Fiona Greig, report author and director of consumer research at JPMorgan Chase Institute. All images courtesy of JPMorgan Chase Institute.In 2016, JPMorgan Chase decided to investigate extraordinary payments, which impact the financial health of families. The company found that these payments of approximately $400 were most likely associated with healthcare costs, auto repairs, and unexpected tax payments. This spurred the company to further investigate what drove healthcare spending for their customers.

The JPMorgan Chase Institute used the anonymized data of 1.2 million JPMorgan Chase members who had checking accounts in 23 states. The researchers then analyzed customers' cash flow and spending habits and weighed the data to reflect demographic statistics from the U.S. census.

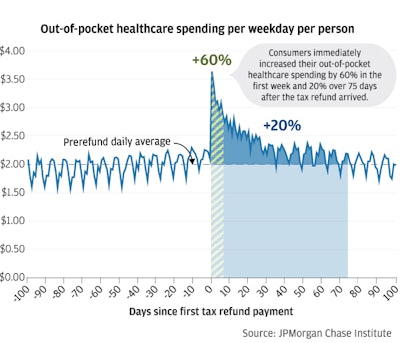

They found that consumer healthcare spending spiked 60% in the days immediately after receiving a tax refund, and spending stayed elevated for about 75 days. Dentists also disproportionately benefited from the spending increase. Dental offices received 32% of in-person payments to service providers in the 75 days following a tax refund, compared with 27% of those payments in the prior 100 days.

Data from "Deferred Care: How Tax Refunds Enable Healthcare Spending," JPMorgan Chase Institute, January 2018.

Data from "Deferred Care: How Tax Refunds Enable Healthcare Spending," JPMorgan Chase Institute, January 2018."What really matters for dentists is that about a quarter of those additional dollars are made in person in dental offices," Greig said. "This suggests that patients were waiting to receive a big cash payment into their bank accounts before attending to some other dental need they had."

Tax season healthcare spending also increased the most for people with the least liquid cash. After a tax refund, healthcare spending increased by 11% for those with more than $3,500 in their checking account, but it increased 220% for those with less than $536 in their checking accounts. In addition, the increase in spending was driven almost entirely by debit card spending with no significant change to credit spending, a finding that surprised Greig.

"It looks like consumers are literally waiting until the day their refund check arrives in their checking account before they start spending that money, and then spending it as soon as it comes in," she said.

Other times dental spending spikes

JPMorgan Chase also found that healthcare spending increases for consumers in October, during open enrollment, and in December, when there are end-of-year bonuses and tax incentives.

Roger P. Levin, DDS, founder and CEO of practice management consulting firm Levin Group.

Roger P. Levin, DDS, founder and CEO of practice management consulting firm Levin Group.Roger P. Levin, DDS, founder and CEO of the Levin Group, told DrBicuspid.com that he typically sees dental spending increase in December, but not March, April, or October. This could be because dental practices are not as dependent on external events or because of steady hygiene programs, he noted.

Greig, however, said that dental practices may not see a spike when consumers receive tax refunds.

"Since tax refunds get paid out over a wide range of days, it may not be noticeable how powerful a demand driver these refund payments are," she said.

Greig suggested that dentists can keep patients coming year-round by reminding them that preventive services typically have no co-pay and that regular hygiene appointments can help prevent higher healthcare costs in the future. Dental offices can also partner with insurance or financial service providers to set up flexible payment programs, helping patients to get care when they need it but pay for it when they get tax refunds or windfalls.

"Some of your patients may benefit from an opportunity to work with you pragmatically on prioritizing what needs to get done right away and what can wait until refund season or bonus season, or some other time when cash flow turns positive," she said. "It looks like, on average, patients are making these kinds of dynamic decisions, so they may welcome an opportunity to do that in partnership with their care providers."